Futures

The experience economy

We’ve been taught to save. But what if we’re wrong? The Experience Economy is an exploration into the future of money: the behaviors of spending, saving, and playing that will shape the future of finance.

Our parents taught us to save and not to overspend, but the youngest generation sees the world a little differently: salaries spent on luxury apartments, spontaneous flights to Santorini, concert tickets to Coachella and flexible work gigs to make it all possible. The shift in how people relate to money is happening right before our eyes—and it’s one our parents may not agree with. Regardless, as designers, it’s our job to ensure financial structures keep up with a changing landscape—and the needs of those users who interact with the products and services therein.

We put ourselves in the shoes of those fresh-out-of-school youth to create products that meet people where they are. This group may be focused on savings, so why not give them a better way to pay for that European vacation, little-by-little? We can integrate social media into day-to-day spending, crowdsource monthly budgets or spice up bank statements with exciting reminders of that night we spent our entire paycheck on a fancy dinner at the top of Eater’s new list.

Futures: Spend it now, because it may be gone tomorrow.

Our country’s financial norms are changing under our noses. Shaped by tenuous expectations of the future—aspiring to have and share experiences, lack of trust in the system, and fear of missing out—emerging generations have an unprecedented perspective on fiscal responsibility: it’s just not that important.

For those of us in the middle of our lives, our parents looked at our financial habits with confused curiosity, as we jumped from job to job, traded security for personal satisfaction, and over-extended our credit to get what we wanted. Meaning? Happiness? Work isn’t about meaning. To these older generations, work is a means to an end: to support a family and build towards a stable and predictable retirement. Now, it’s our turn to look at the Kids Today with the same curiosity and confusion. No savings? Traveling the world on a whim? Living in parents houses? Broadcasting pictures of expensive meals and nights at the club? There’s little planning, investments, or long-term outlook—and what’s more, they don’t seem to care!

Older generations inherited financial norms and a financial system, then changed those structures to support our own lifestyles and expectations. Now, those structures are widely accepted as immutable, and others are judged based on how well they navigate and use those structures. Save. Invest. Plan. Diversify. But those financial structures are increasingly meaningless to future generations—because they have fundamentally different priorities.

What about living in the moment? What about experiences? What does a financial system look like that’s built just for now rather than later?

Here at Narrative we work with big brands to make it possible for our clients to connect with their audiences with depth and accuracy. It all begins with ideation—throwing around ideas that could turn into products that spur systemic change. “The Experience Economy” is an exploration into just a few of these ideas for the future of finance.

It’s the end of credit cards—everyone’s a lender! Shoes for a few bucks, Uber for a dollar, and a burger for pennies. Don’t sweat the future payments—that’s something to deal with later. You’re hungry now!

WeShop™

Go shopping with your friends—online.

Why buy it yourself, when you can buy it together? Get those new kicks, or great meal, without the guilt. It’s your money, but their decision—poll your friends and let the group make the call.

Alexa, if you’re so smart, stop asking us questions—just do it for us! Alexa knows what you want better than you do, and since she knows what your friends are up to, you can one-up them with the latest and greatest.

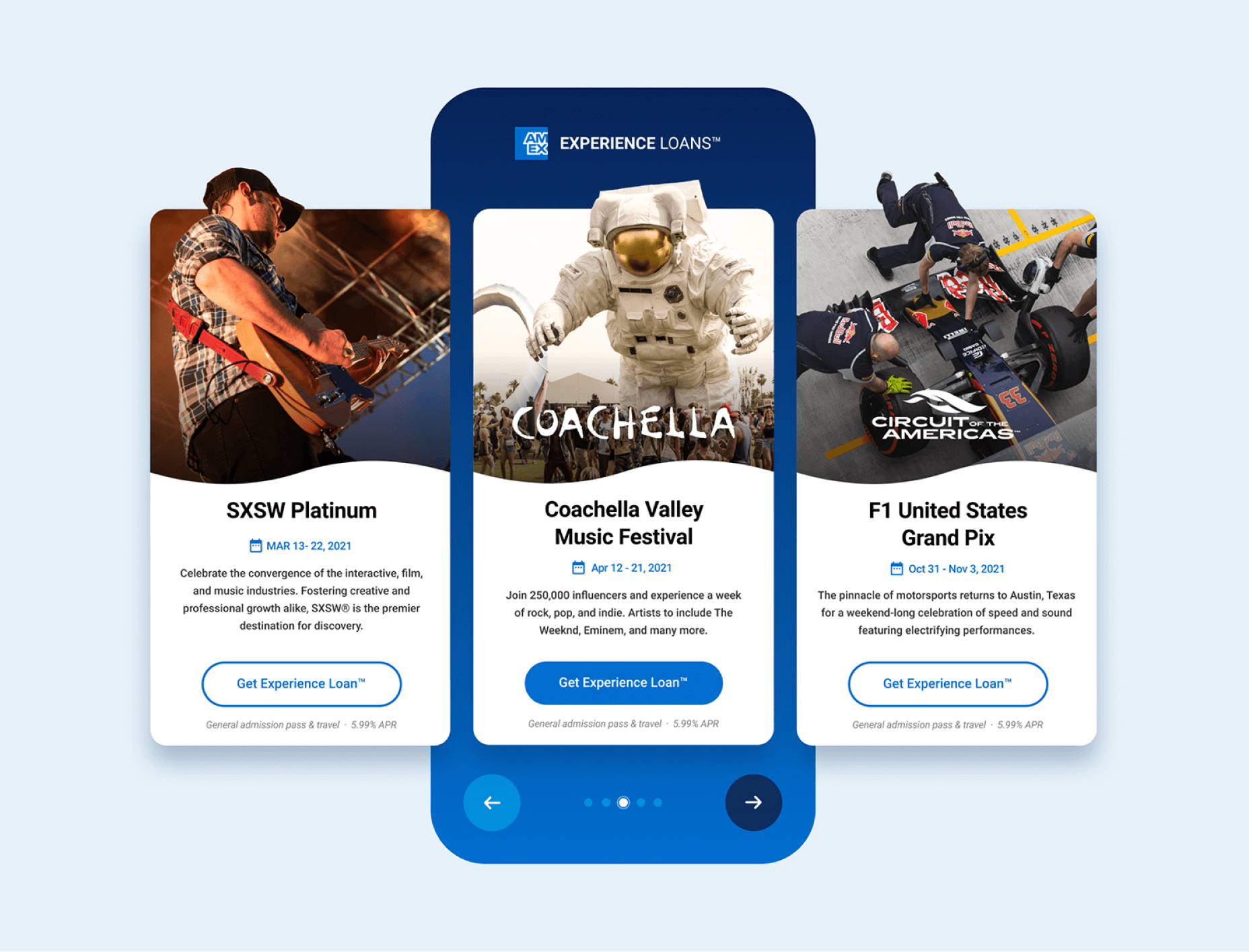

First class travel, front row seats, and the best selfies you can take. And all at a low rate APR of 5.99%!

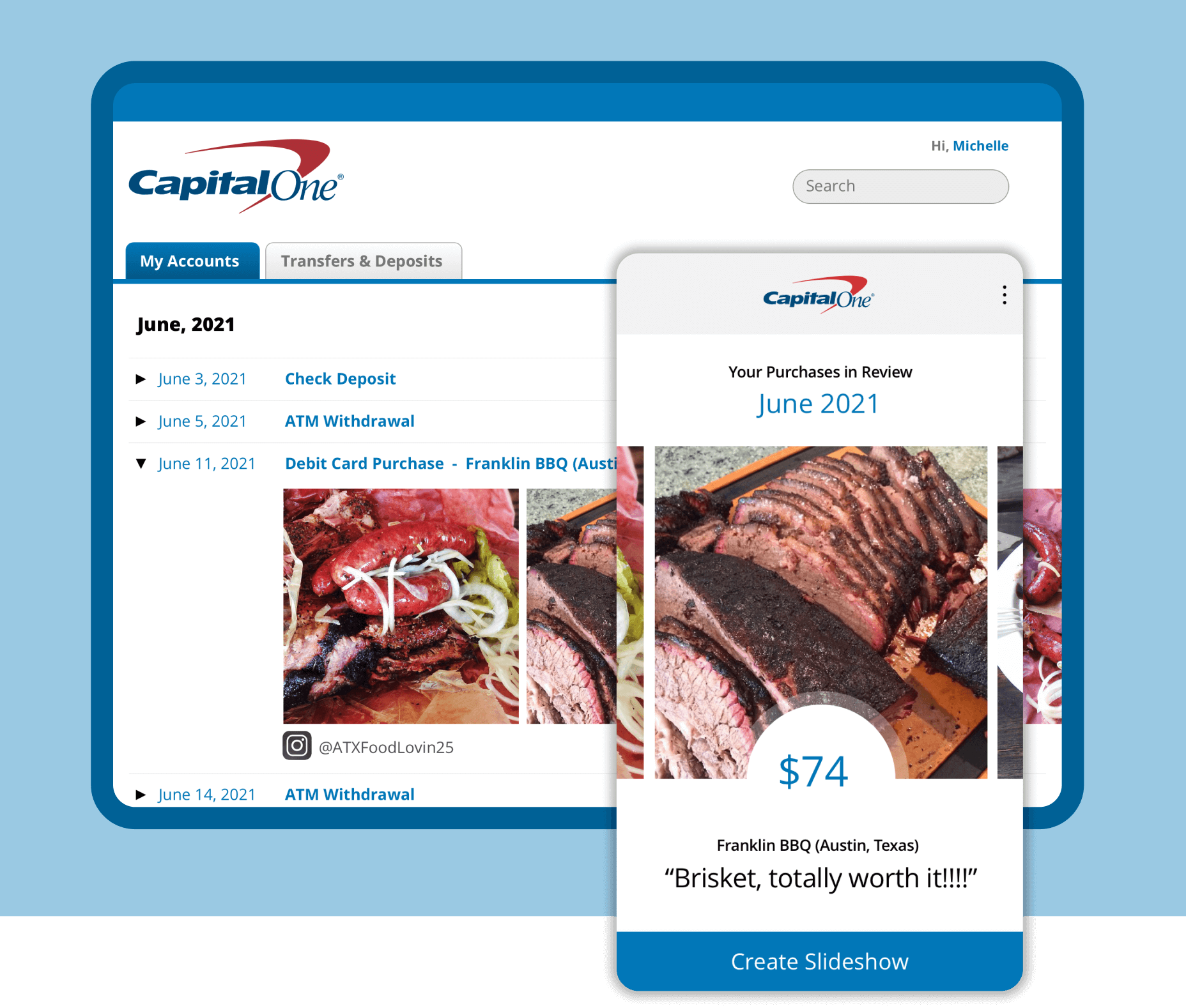

At the end of each month, share your haul with friends in a slideshow of everything you bought.

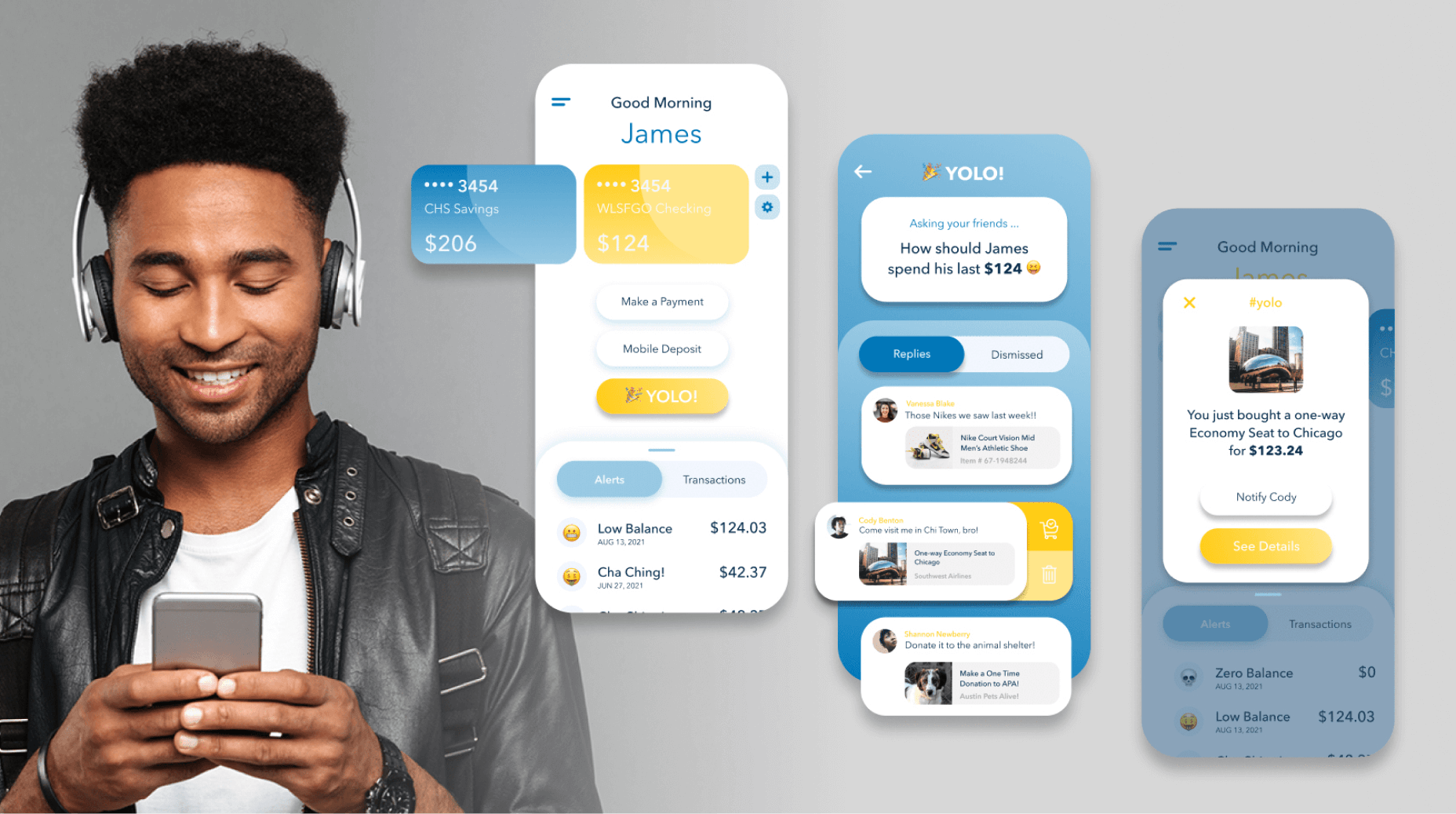

Ask your friends for great ideas, and—YOLO!—go out with a bang. For extra points, play it like a Showcase Showdown and ask your friends to get it as close to $0.00 as possible!

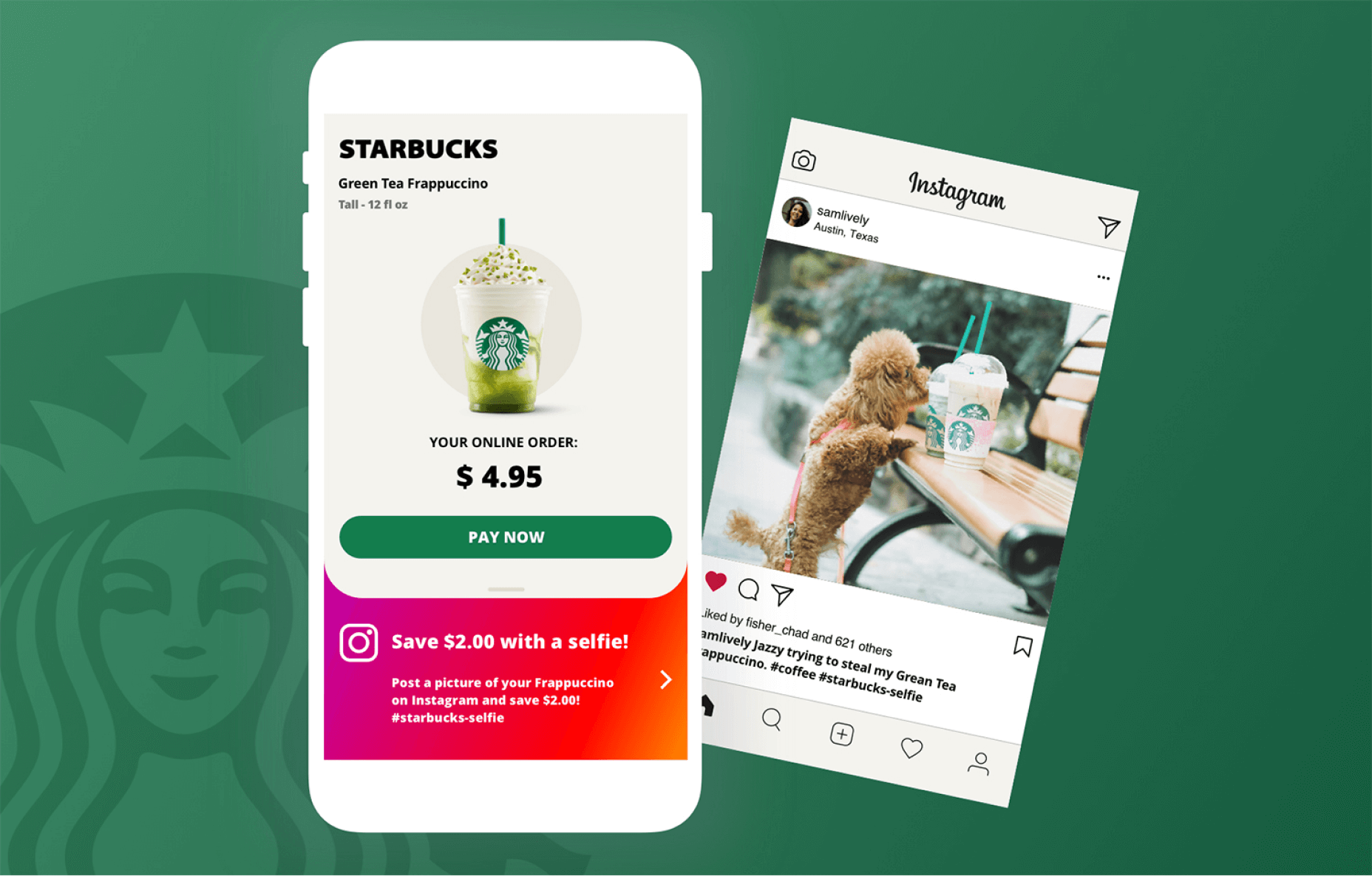

Our retail partners have created great discounts just for you; share your purchases on insta and save a buck or two.

Subscribe to our newsletter

Receive email updates to stay informed about our latest blog posts, design futures, and company updates.